Understanding Workers’ Compensation for Seasonal Workers in Pennsylvania

Employers often rely on seasonal or temporary employees to help keep up with busy holiday seasons. While seasonal work provides flexibility and opportunities for individuals looking to supplement their income or gain valuable experience, it’s crucial for seasonal workers to understand their rights and protections – especially when it comes to workers’ compensation.

Seasonal workers, like full-time employees, are covered by the Pennsylvania Workers’ Compensation Act, and thus are entitled to workers’ compensation benefits. Even though seasonal workers often work limited hours or for a limited period, they are still at risk of encountering occupational hazards that give rise to benefits.

Who Isn’t Covered by the Seasonal Employer?

Seasonal workers are short-term employees hired to help an employer meet their short-term needs during a specific time of year. For example, seasonal workers may be hired at a retail store during the holiday season or as a lifeguard during the summer months. In general, seasonal workers are entitled to the benefits, including workers’ compensation coverage, enjoyed by full-time employees.

In Pennsylvania, however, there are exceptions to this general rule. A seasonal worker hired from a temporary staffing agency, or a temp agency, is not covered by the seasonal employer’s insurance. A temp agency is a staffing partner that supplies employers with ready-to-work candidates who can temporarily fill a number of different roles. When a person is hired through a temp agency, they are technically employees of the agency – not the company where they’ll be working temporarily. Therefore, the temp agency provides the workers’ compensation insurance. So, if a seasonal worker, hired by a seasonal employer through a temp agency, is hurt on the job, the temp agency is the employer for purposes of a workers’ compensation claim.

Independent contractors are also not covered by workers’ compensation. Independent contractors are self-employed individuals who enter into a contract with a company to perform specific tasks or projects. They maintain control over how they perform the work and are not considered employees of the company. Independent contractors are typically free to work where and when they choose, use their own tools, and send invoices for payment. Conversely, an employee is someone who performs services set and controlled by the employer in exchange for a paycheck. The distinction between an independent contractor and a traditional seasonal employee can be a fuzzy one – but can also mean the difference in your ability to recover.

Key Points to Remember

For all workers in Pennsylvania, eligibility for workers’ compensation benefits depends on various factors, including the nature of employment and the specific circumstances of their injury or illness. While seasonal workers may not work year-round, they are still entitled to workers’ compensation benefits if they meet certain criteria. The following key points are important to keep in mind when taking on seasonal work.

- Know Who Hired You: To be covered by your temporary employer’s workers’ compensation insurance, it is important to know who hired you. If you are an independent contractor or hired by a temp agency, you may not be entitled to the same benefits enjoyed by full-time employees. If you are unsure who hired you, read your employment contract to find out who is responsible if you are injured on the job. Be sure your employer did not misclassify you as an independent contractor.

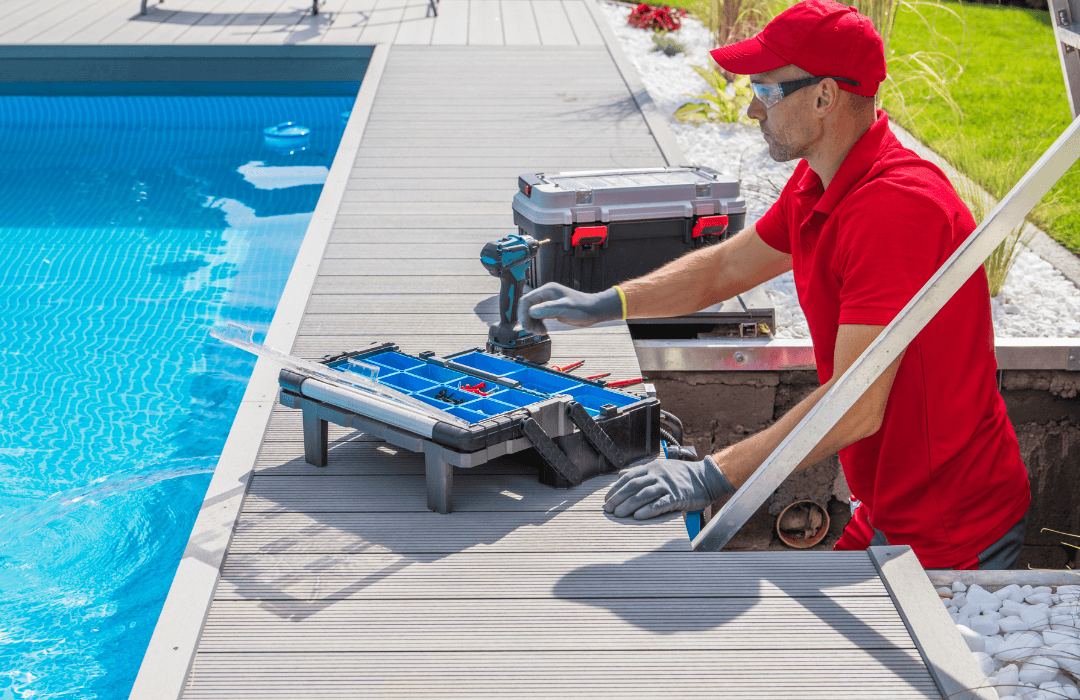

- Recognize Injuries Common Among Seasonal Workers: Most seasonal workers are hired to assist employers during particularly busy, hectic, and fast-paced times. This means seasonal workers are less likely to undergo formal training for their role. Consequentially, they will likely rush to keep up with demand and are more prone to overexert themselves on the job. Seasonal workers often encounter accidents while packing, lifting, or stocking heavy merchandise, engaging in outdoor maintenance duties, and navigating delivery routes.

- Understand Your Benefit Entitlements: Following a promptly reported work-related injury, seasonal workers may be entitled to reasonable medical expenses, lost wages, temporary disability benefits, and/or permanent disability benefits. A seasonal worker’s temporary disability benefit is calculated differently in-season and off-season. For in-season injuries, temporary disability benefits are typically calculated based on the earnings the worker would have received during the period of employment if the injury hadn’t occurred. This ensures that seasonal workers receive fair compensation that reflects the income they would have earned had they not been injured during the peak season of their employment. For injuries occurring during the off-season, benefits are determined based on the worker’s past earnings and potential income. This considers their average earnings over time and what they could have earned during the off-season if they hadn’t been injured.

Ensuring Fair Compensation for Seasonal Workers

Seasonal workers play an important role in the Pennsylvania workforce. Employers rely on them to help navigate some of the busiest times of year, so their protections should reflect that great responsibility. By understanding the eligibility criteria, recognizing common challenges, and utilizing available resources, seasonal workers can assert their rights and receive the support they need in the event of a work-related injury or illness.

Navigating the workers’ compensation system can be complex, especially for seasonal workers who may be working for an unfamiliar employer. Seeking legal assistance can be instrumental in ensuring that seasonal workers receive the benefits they are entitled to under Pennsylvania law.